By Andrew Hutchinson

The legal industry is getting with the program, so to speak. Like many industries before it – including technology, financial services and manufacturing – a large part of the legal industry now recognizes data is a strategic asset. Further, modern law firms are now striving to build data-driven cultures enabled by emerging and innovative technologies like artificial intelligence (AI), cloud computing and blockchain.

Progress has been made on this front, but it’s still early in the new technology adoption curve for this industry. Despite the fact that law firms possess significant amounts and types of data, it is often fragmented by lawyer or practice silo. In fact, the Intapp Experience Management Survey 2017 found that 42% of firms lack a centralized process to collect, store and analyze data on an ongoing basis.

Siloed data makes it impossible to derive the necessary insights and collabor ate effectively. And most of the centralized systems and processes that do exist are legacy systems – e.g., spreadsheets, generic CRMs, SharePoint – that are incompatible with the rest of the firm’s technology and workflow processes.

ate effectively. And most of the centralized systems and processes that do exist are legacy systems – e.g., spreadsheets, generic CRMs, SharePoint – that are incompatible with the rest of the firm’s technology and workflow processes.

The result? Legal practices are missing business opportunities as the complexity of engagements continues to increase. And firms are losing market share to competitors that take a more modern approach to data. This dynamic has become a major issue facing law firms in the client-empowered era that exists today with more discerning, price-sensitive clients and leaner margins.

While the top 1% of global firms will be insulated from profitability concerns for the foreseeable future, the other 99% need to take action based on data-driven decisions in collaboration with institutional knowledge.

The CMO’s dilemma

While the scenario above applies to all functional areas of a law firm, the problem is particularly acute with marketing.

Rather than delivering proactive client insights that inform new business opportunities, many law firm marketing departments remain mired in administrative work due to the heavy responsibility of manual data gathering. In a 2018 Bloomberg Law study, legal marketeers cited “lack of time” as their No. 1 challenge.

Eliminating the manual data gathering tasks to free up time for strategic consultation is critical. CMOs, in particular, cannot discuss strategy with lawyers and identify new business opportunities without the necessary insights that come from client data and relationship knowledge.

The modern law firm and technology innovation are inextricably connected

When people ask me what being a “modern” law firm entails, I tell them it means employing strategies, initiatives and investments that enable the firm to keep pace with rapidly changing client demands, market conditions and new technologies. These modernization initiatives typically involve unifying people, processes and data.

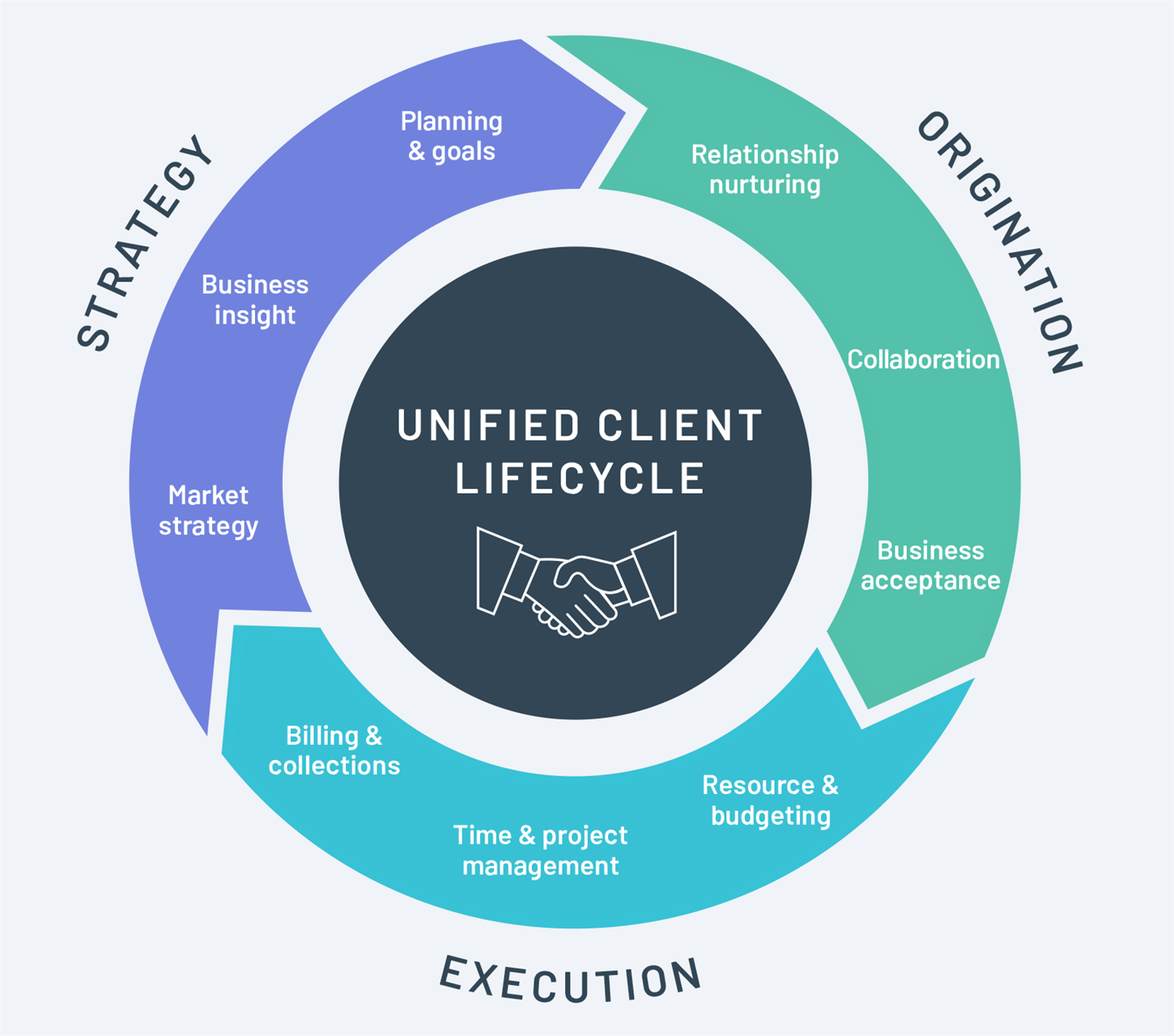

The most successful firms are those that transition their organizations from a reactive to an insights-based posture. Making this transition accelerates a firm’s ability to win business with both new and existing clients. The key is unifying data across the entire client lifecycle so the people who need it are able to easily access it. Data that flows with limited friction throughout a firm – where and when it is needed – delivers insights and value.

The most successful firms are those that transition their organizations from a reactive to an insights-based posture. Making this transition accelerates a firm’s ability to win business with both new and existing clients. The key is unifying data across the entire client lifecycle so the people who need it are able to easily access it. Data that flows with limited friction throughout a firm – where and when it is needed – delivers insights and value.

So how do these modern firms make the transition? The highest-impact move is to replace legacy systems with a robust, full client lifecycle platform that facilitates key client planning (the “80-20 rule,” where 80% of an organization’s profits come from 20% of its customers, is just as true in the legal industry) to better positioning themselves for growth.

Specific to marketing, a unified system powered by modern technologies like AI and cloud computing eliminates “random acts of marketing” and allows CMOs to spend more time, energy and discipline on enhancing the client experience.

By the same token, lawyers can use the best possible and most up-to-date data to make decisions, increasing their chances of exceeding client expectations and keeping retention rates high.

The net-net: by making the move to a modern, unified platform, firms gain the ability to use their data to seize nearly every opportunity for growth as opposed to not having the data they need and missing opportunities.

Data may or may not be the “new oil” as the (now clichéd) maxim goes. But it’s pretty clear that every business operates in what is now a data economy. So it’s not surprising that law firms – armed with the right data at the right time in the hands of the right people – can extract insights that drive better decision-making. And better decisions are every firm’s best fuel source for revenue growth and continued profitability.

About the Author

.jpg)

Andrew Hutchinson is Practice Group Leader – Marketing and Business Development – North America for Intapp, a provider of Client Lifecycle Management solutions to law firms and other professional services organizations. Andrew has spent the last 15+ years working with a broad cross-section firms in EMEA and North America, helping them drive innovation in the delivery of services through the use of technology, including: CRM; Document Management; Finance; Case Management; and Business Process Management.

In his current role, he helps firms achieve strategic objectives around growth and client management with the help of OnePlace. As part of this process, he spends considerable time both listening and presenting to key stakeholders, including firm leadership, marketing and business development teams, and the fee earner community. He has a deep understanding of the role marketing and business development play in the wider law firm context, along with the range of objectives they seek to achieve, and uses this knowledge to support them in driving both effectiveness and efficiency.